Document Intelligence Platform

Transform Mortgage Processing with DocIQ

Automate document intake, extraction, and analysis—turn hours of paperwork into actionable insights. Accelerate approvals, ensure compliance, and boost productivity across the entire loan lifecycle..

The Mortgage Processing Challenge

Mortgage enterprises face document-heavy workflows that slow approvals, increase errors, and elevate compliance risks—ultimately reducing customer satisfaction.

The DocIQ Solution

DocIQ automates intake, extraction, and analysis, turning hours of paperwork into actionable insights in minutes. Enable faster approvals, compliance confidence, and productivity gains across the loan lifecycle.

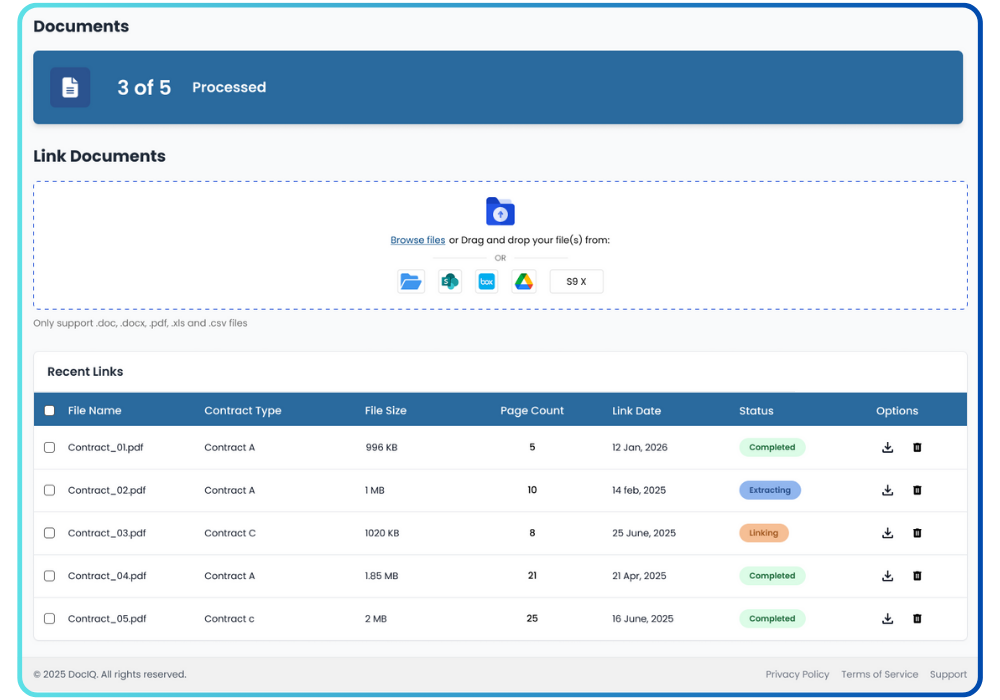

Automated Document Intake

Documents arrive from multiple channels and are automatically captured, classified, and routed to the correct loan files within second.

Benefits:

- Multi-channel document capture

- Intelligent document classification

- Automated file organization

- Real-time processing status

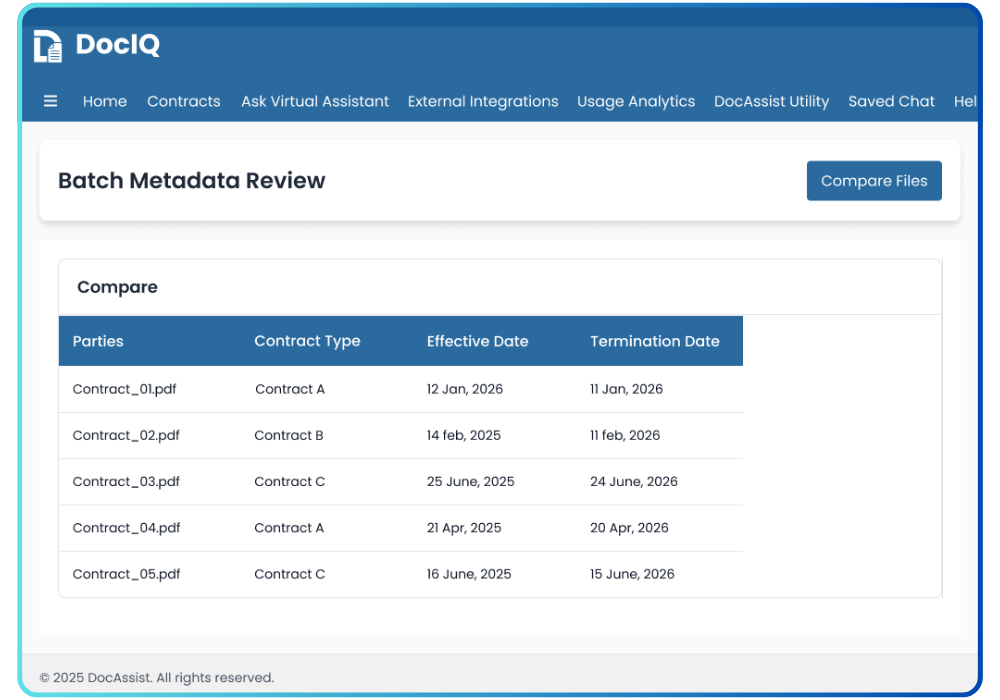

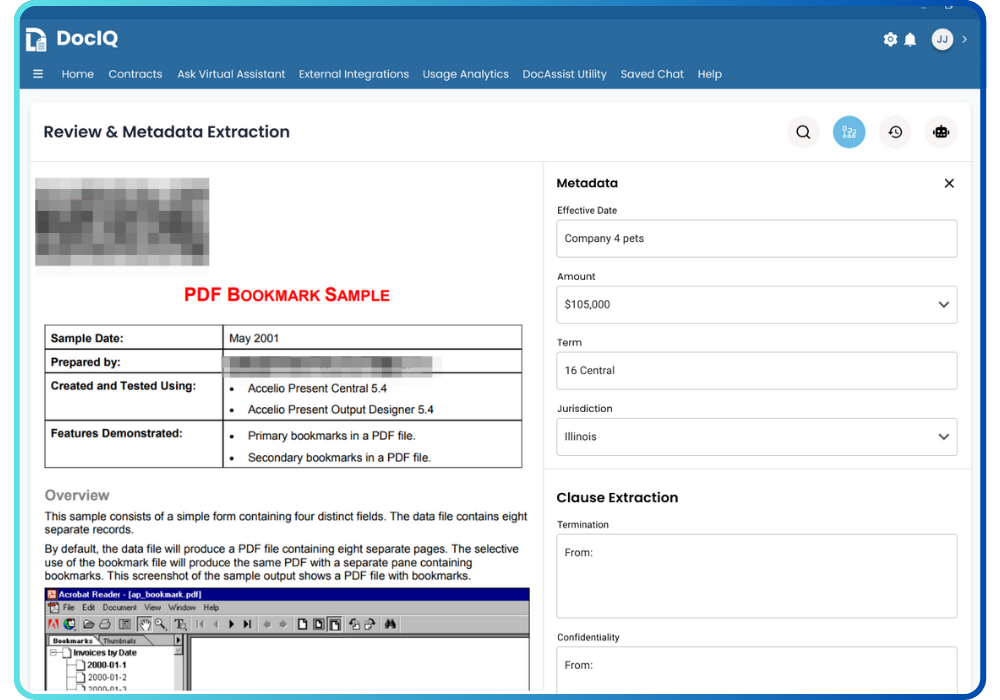

Precision Data Extraction

Advanced AI engines accurately extract critical data from unstructured documents, transforming them into structured, actionable insights.

Benefits:

- Industry-leading extraction accuracy

- Supports over 50 document types

- Clean, structured data output

- Automated exception handling

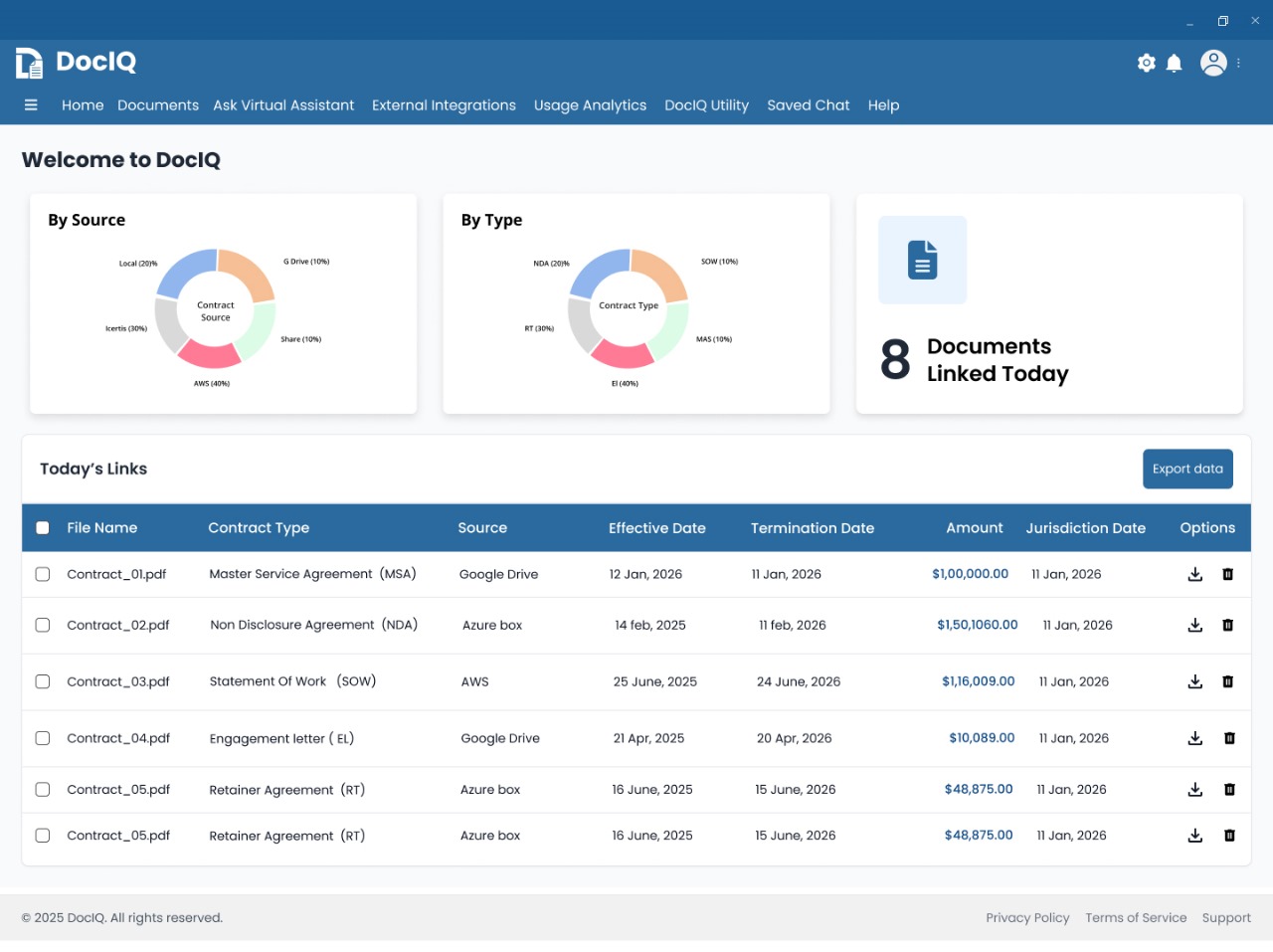

Intelligent Document Analysis and Decision Support

Turn complex financial documents into clear, actionable insights with our advanced AI-driven analysis. Automatically assess borrower financials, calculate income ratios, detect discrepancies, and flag compliance concerns delivering precise recommendations directly to underwriters and loan officers. Make faster, smarter lending decisions with confidence.

Benefits:

- Streamlined income calculations for quicker approvals

- Early identification of risk factors

- Built-in compliance checks for reduced regulatory exposure

- Insightful trend analysis and reporting to guide strategy

Measurable Results for Mortgage Enterprises

DocIQ transforms mortgage workflows, delivering faster, smarter, and more reliable operations.

Key Outcomes:

- Accelerated Loan Processing: Complete document handling and reviews in a fraction of the time, enabling faster approvals and quicker borrower responses.

- Enhanced Data Accuracy: Minimize errors and ensure that every piece of information is captured correctly the first time, reducing rework and compliance risks.

- Operational Efficiency: Streamline workflows, freeing teams to focus on high-value tasks instead of repetitive manual processes.

- Continuous Workflow: Keep loan processing moving smoothly with automated document handling around the clock, without bottlenecks or delays.

DocAssist transforms mortgage processing by automating intake, extraction, and analysis—turning hours of paperwork into minutes of insights. Enterprises gain speed, compliance confidence, and productivity boosts across the loan lifecycle.